It's the time to put up for sale..

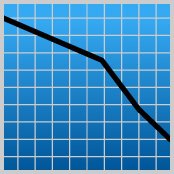

Now Investors are selling off Floating rate notes, whose Interest payments depend on the central bank policy and they are fascinating towards the fixed interest rate bonds.

Floating rate notes will give better average returns than fixed rate bonds. But lower interest rates in the market are pushing the investors towards the fixed rate bonds. They are all buying fixed rate bonds, something they can get capital when the yields go down.